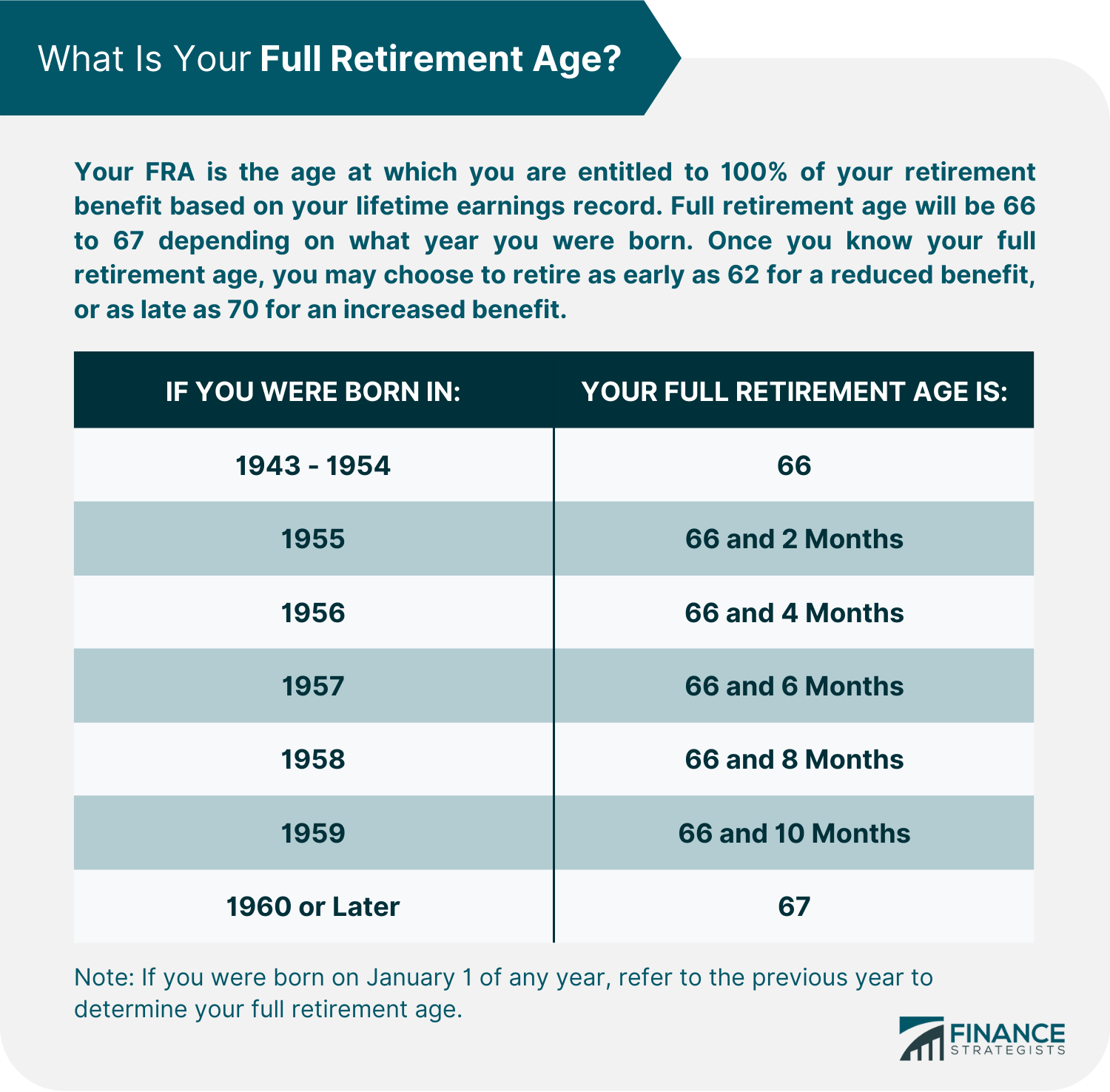

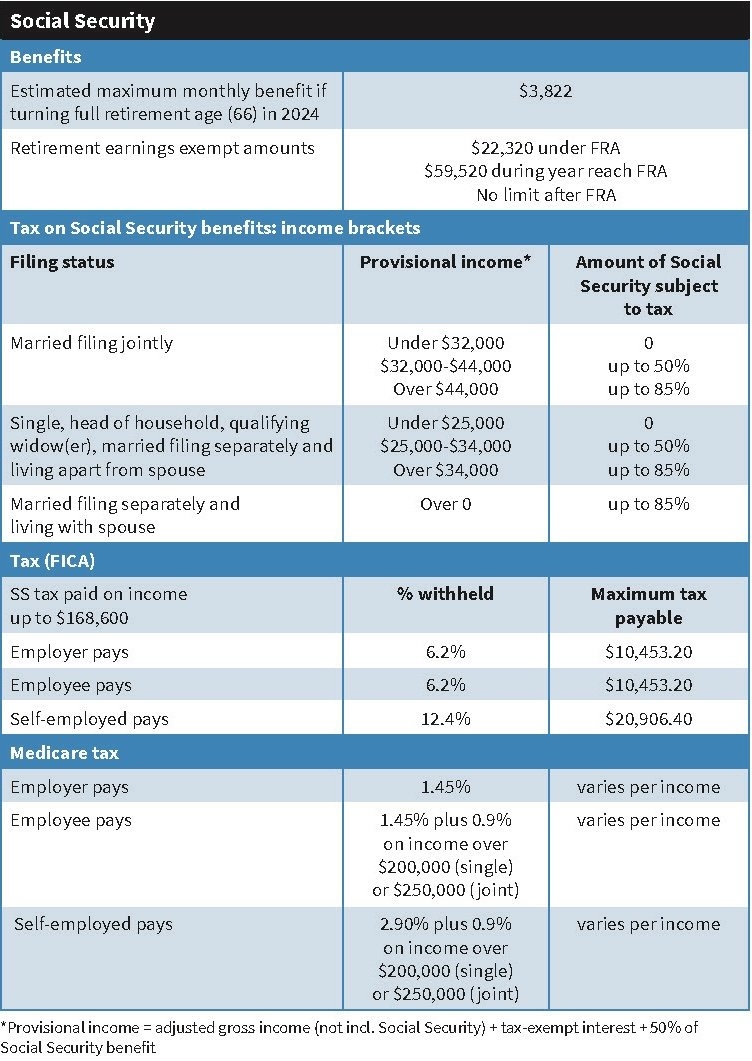

Are you curious about how much of your social security income is taxable in 2024? Understanding the tax implications of your retirement benefits is essential for financial planning.

While most people know that some of their social security income may be taxed, the exact amount can vary depending on your total income and filing status.

estimate of social security which is taxable for 2024

Estimate of Social Security Which is Taxable for 2024

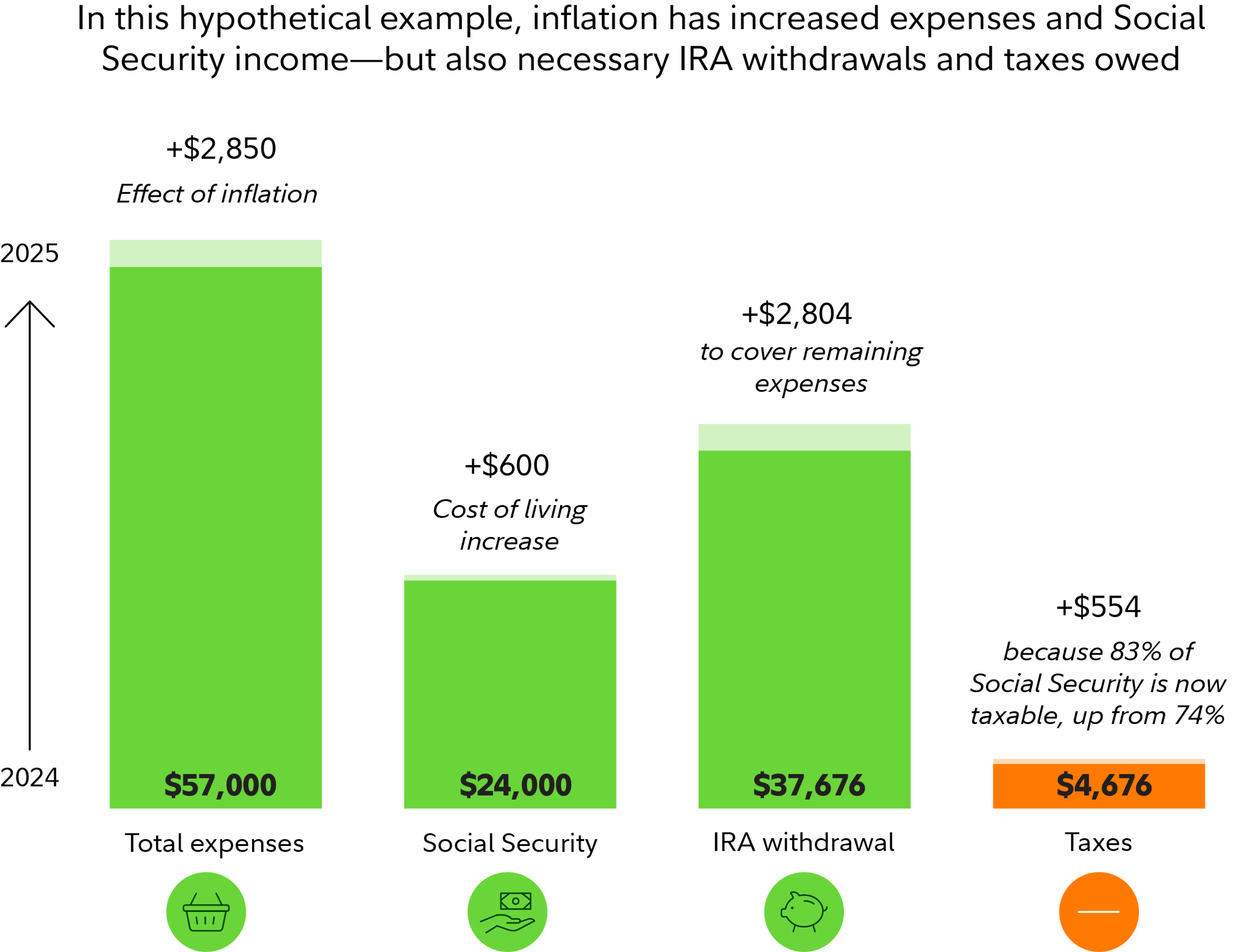

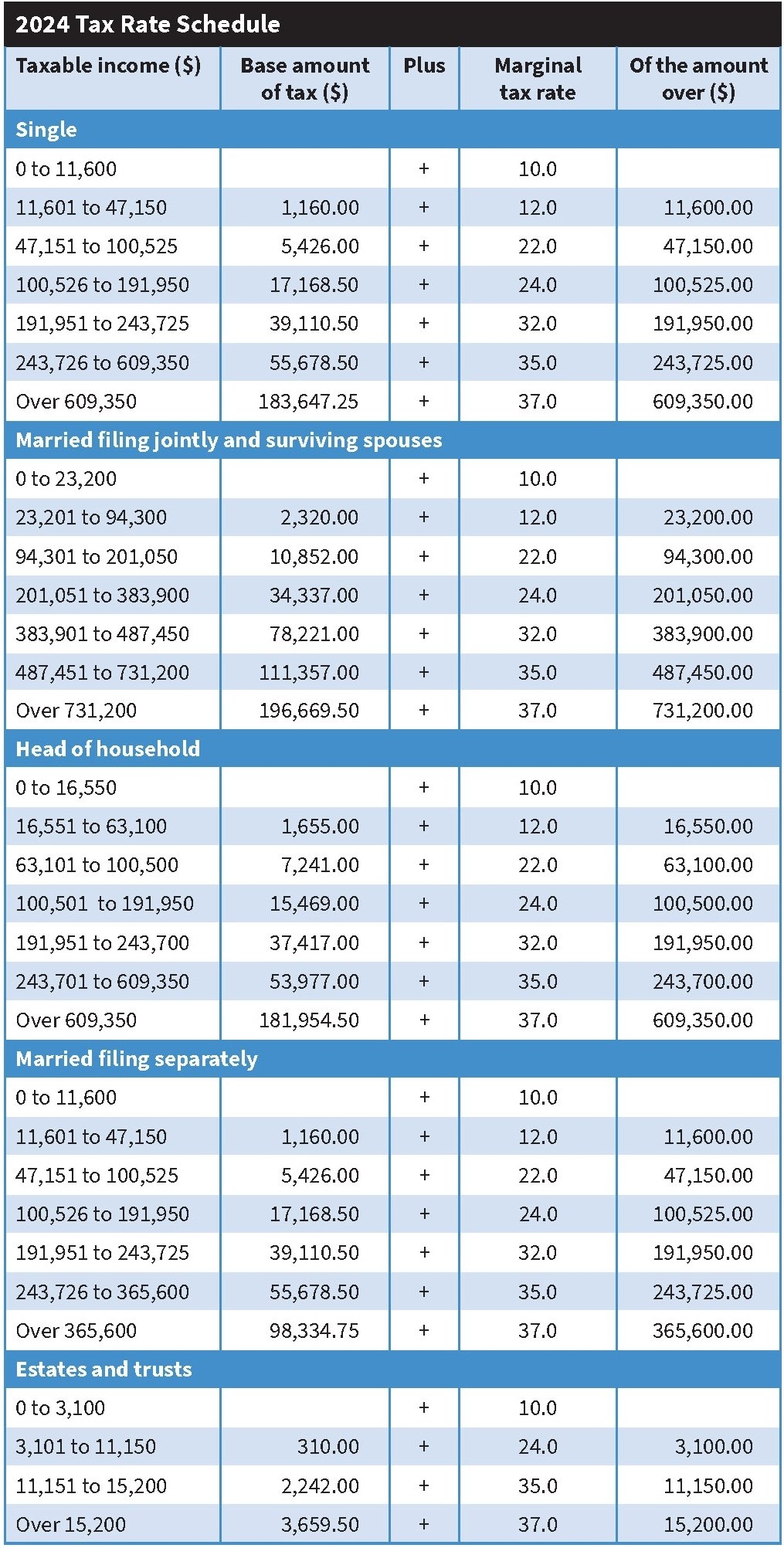

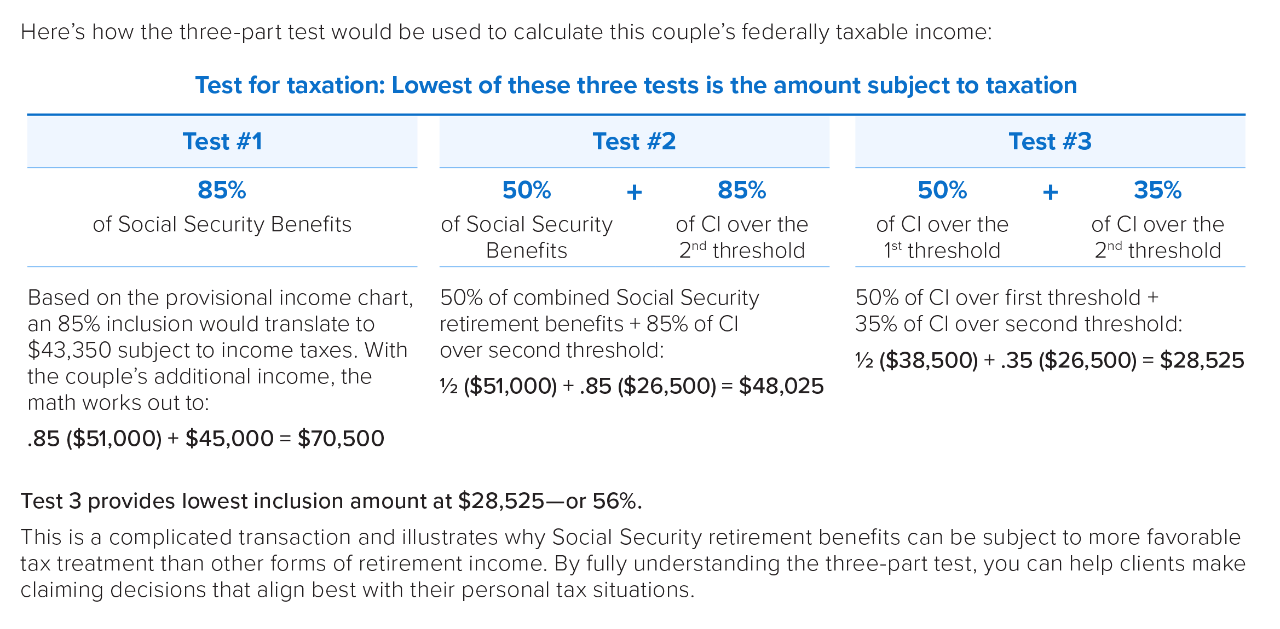

For individuals with a combined income between $25,000 and $34,000, up to 50% of their social security benefits may be subject to taxation. For those with a combined income over $34,000, up to 85% of their benefits could be taxable.

It’s important to note that not all social security income is taxable. Factors such as your filing status and other sources of income can impact the percentage of benefits subject to taxation.

Consulting with a tax professional can help you better understand your specific situation and make informed decisions about your retirement income. By planning ahead, you can minimize the tax impact on your social security benefits and maximize your overall financial well-being.

Stay informed about changes in tax laws and regulations that may affect the taxation of your social security income. Being proactive and seeking professional guidance can help you navigate the complexities of retirement planning with confidence.

Tax Guide And Resources For 2024 TAN Wealth Management Certified Financial Planner CFP San Francisco Advisor

Social Security Benefits How Much Is Subject To Taxes

Maximum Social Security Benefit 2024 Calculation

How To Calculate Taxes On Social Security Benefits Kiplinger

Tax Guide And Resources For 2024 TAN Wealth Management Certified Financial Planner CFP San Francisco Advisor